Prescription Cost Comparison Calculator

Your Medicare Part D Details

SingleCare Discounted Prices

Cost Comparison Results

Medicare Part D Annual Cost

SingleCare Annual Cost

Your Annual Savings

Important: This calculator shows potential savings but doesn't account for:

- Medicare's catastrophic coverage phase

- Drug coverage gaps (donut hole)

- Specialty drug coverage

- Medicare Advantage plan benefits

If you’re paying for prescriptions out of pocket, you’ve probably wondered: SingleCare is cheaper than Medicare? The answer isn’t simple - it depends on what part of Medicare you’re enrolled in, what drugs you take, and where you fill your prescriptions. SingleCare isn’t insurance. It’s a discount card. Medicare is federal health coverage. They work differently, and comparing them directly can be misleading.

What SingleCare Actually Does

SingleCare is a free prescription discount program. You sign up online or through their app, get a card (digital or printed), and show it at participating pharmacies. It doesn’t cover your drug like insurance. Instead, it negotiates lower cash prices with pharmacies. You pay the discounted rate - no copay, no deductible, no monthly fee.

For example, a 30-day supply of metformin might cost $15 at your local pharmacy with insurance. With SingleCare, it could drop to $4. That’s a 73% savings. But if you’re on Medicare Part D, your copay for that same drug might already be $5. Suddenly, SingleCare doesn’t look so much better.

SingleCare works best when you’re uninsured, underinsured, or your Medicare plan doesn’t cover your drug well. It’s also handy for people who haven’t reached their Medicare Part D deductible yet. Once you hit that deductible, your copays drop - and SingleCare may not beat them.

How Medicare Handles Prescription Costs

Medicare Part D is the part that covers prescriptions. Every plan is different. Some have low monthly premiums but high deductibles. Others have higher premiums but cover more drugs with lower copays. The key is the formulary - the list of drugs your plan covers and at what tier.

Let’s say you take lisinopril for high blood pressure. Your Medicare Part D plan puts it on Tier 1 - generic drugs. Your copay is $3. You fill it every month. Over a year, that’s $36. With SingleCare, you might get it for $2. So technically, SingleCare wins by $1 a month. But if you’re already paying $15/month for your Part D plan, that $15 is worth it if it covers 10 other drugs too.

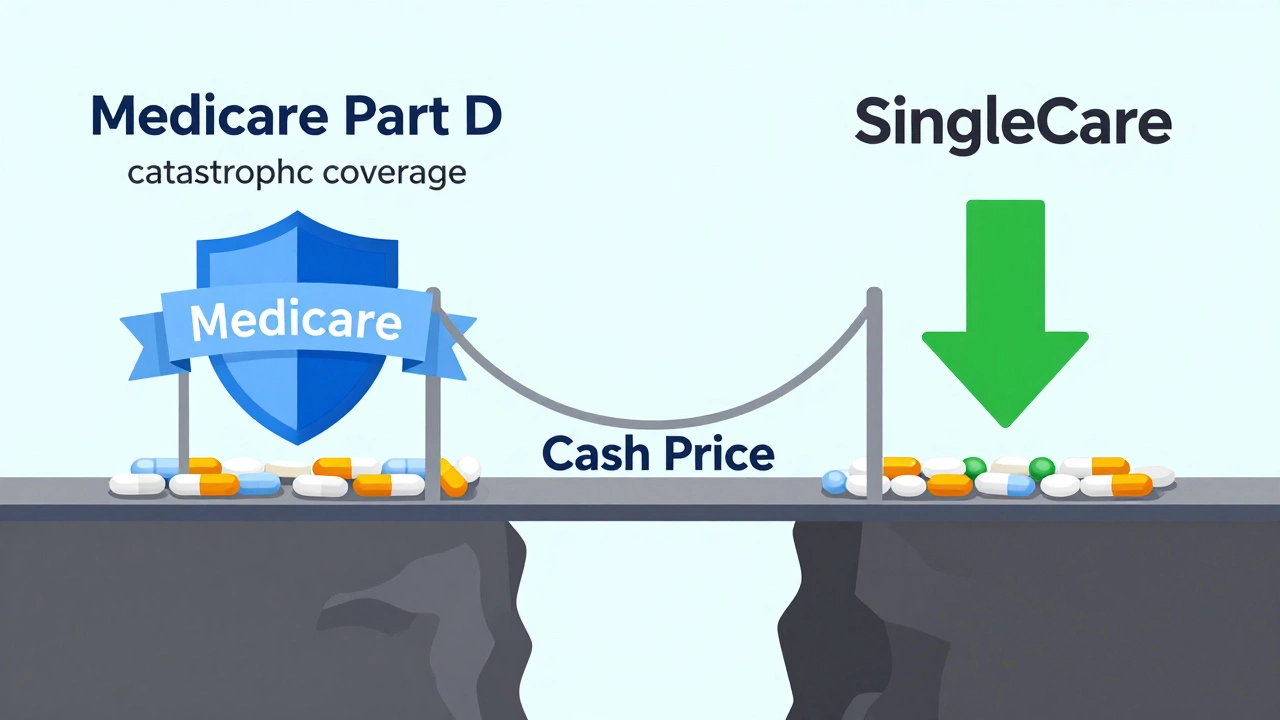

Medicare Part D has a coverage gap - the donut hole. In 2026, once you and your plan spend $5,030 on covered drugs, you enter the gap. You pay 25% of the drug’s cost until you hit the catastrophic threshold. SingleCare doesn’t count toward this. So if you’re in the donut hole, SingleCare can save you real money because you’re paying full price.

When SingleCare Beats Medicare

There are real cases where SingleCare saves more than Medicare Part D:

- You’re on Medicare but your plan doesn’t cover your drug at all. SingleCare might be your only option for a discount.

- You’re in the donut hole and your drug isn’t on a preferred tier. SingleCare prices can be 50-80% lower than the cash price.

- You take a brand-name drug with no generic. Medicare might charge you $120. SingleCare might bring it to $45.

- You’re not enrolled in Part D at all. That’s risky - you’ll pay a late enrollment penalty if you sign up later. But if you’re only taking one or two meds, SingleCare might be cheaper than paying Part D premiums.

A 2024 study by the Kaiser Family Foundation found that for people paying full cash price for prescriptions, SingleCare saved an average of 54% compared to the list price. For Medicare beneficiaries in the coverage gap, the average savings was 61%. That’s not small change.

When Medicare Still Wins

Don’t ditch Medicare Part D just because SingleCare looks cheaper on one drug. Here’s why:

- Medicare Part D covers hundreds of drugs. SingleCare only works on the ones pharmacies agree to discount. You can’t use it for specialty drugs, injectables, or some controlled substances.

- Part D premiums count toward your out-of-pocket maximum. SingleCare payments don’t. Once you hit catastrophic coverage, Medicare pays 95% of your drug costs for the rest of the year. SingleCare can’t match that.

- If you’re on Medicaid or Extra Help, your copays are already $0-$4. SingleCare won’t save you anything.

- Some Medicare Advantage plans include Part D and have $0 premiums. If your drugs are covered, you pay nothing.

Take someone on a Medicare Advantage plan with $0 premium and $5 copays for all generics. They take five drugs a month. Total monthly cost: $25. SingleCare might save them $3 on one drug. But they’d have to pay cash for the other four. Their total out-of-pocket could jump to $40. That’s a loss.

How to Compare Your Drugs

Don’t guess. Compare. Here’s how:

- Make a list of every prescription you take - name, dose, frequency.

- Check your Medicare Part D plan’s formulary. Find the copay for each drug.

- Go to SingleCare.com. Enter each drug and your zip code. Note the discounted price.

- Calculate your annual cost under Medicare: (copay × 12) for each drug.

- Calculate your annual cost with SingleCare: (discounted price × 12) for each drug.

- Add your Part D monthly premium to the Medicare total.

Example: You take three drugs. Medicare copays: $4, $8, $12. Premium: $30/month. SingleCare prices: $3, $5, $10.

Medicare total: ($4 + $8 + $12) × 12 = $288 + ($30 × 12) = $648

SingleCare total: ($3 + $5 + $10) × 12 = $216

SingleCare saves $432 a year. That’s real money. But only if you’re not using your Part D plan at all - which means you’re risking a penalty if you sign up later.

Can You Use Both?

Yes - and you should.

Medicare Part D and SingleCare are not mutually exclusive. You can’t combine them on one transaction - pharmacies won’t let you stack discounts. But you can use them strategically.

Use Medicare for drugs it covers well. Use SingleCare for drugs it covers better. If your Part D plan doesn’t cover your thyroid med, but SingleCare gets it for $10, use SingleCare. If your insulin copay is $35 under Medicare but SingleCare gets it for $25, use SingleCare.

Keep your Medicare Part D enrollment. Don’t cancel it. Just use SingleCare as a backup when it saves you more. Many people do this without even telling their pharmacist.

What About Other Discount Programs?

SingleCare isn’t the only option. GoodRx, RxSaver, and even pharmacy loyalty programs (like Walmart’s $4 list) compete. But SingleCare often has the lowest prices for non-formulary drugs.

GoodRx sometimes matches SingleCare. But GoodRx doesn’t always work at every pharmacy. SingleCare has wider network coverage - over 60,000 locations, including CVS, Walgreens, and independent pharmacies.

Walmart’s $4 list is great for common generics - but only if your drug is on the list. SingleCare works for more drugs, including brand names.

Bottom Line: It Depends on Your Drugs and Your Plan

SingleCare isn’t cheaper than Medicare - it’s cheaper than cash prices. Medicare is cheaper than no coverage.

If you’re on Medicare and your drugs are covered well, stick with your plan. The peace of mind, catastrophic protection, and broad coverage are worth more than a few dollars saved on one drug.

If your Medicare plan leaves you paying high cash prices - especially for brand-name or non-formulary drugs - SingleCare can cut your bills in half. Use it as a tool, not a replacement.

Check both every year. Drug prices change. Plans change. Your needs change. A program that saved you $100 last year might not save you anything this year. Stay informed. Stay in control.

Can I use SingleCare with Medicare Part D?

Yes, you can use SingleCare alongside Medicare Part D, but not on the same prescription. You can’t combine discounts at the pharmacy counter. However, you can choose which option to use for each drug - use Medicare for drugs it covers well, and SingleCare for drugs it saves you more on.

Is SingleCare free to use?

Yes, SingleCare is completely free. There are no sign-up fees, monthly charges, or hidden costs. You just show your card or app code at the pharmacy and pay the discounted price.

Does SingleCare work for brand-name drugs?

Yes, SingleCare often works for brand-name drugs, especially those without generics. It can save you 30% to 80% off the cash price. This is especially helpful if your Medicare plan doesn’t cover the drug or puts it on a high tier.

What if I’m in the Medicare donut hole?

The donut hole is when SingleCare shines. Once you hit the coverage gap, you pay 25% of the drug’s price under Medicare. But if SingleCare brings the cash price down significantly, you might pay less than that 25%. Always check both prices before filling your prescription.

Should I drop my Medicare Part D for SingleCare?

No. Dropping Medicare Part D to use SingleCare alone puts you at risk for a late enrollment penalty if you try to sign up later. That penalty lasts as long as you have Part D. SingleCare is a discount tool - not insurance. Keep your Part D coverage and use SingleCare to fill gaps.

How do I find out which pharmacies accept SingleCare?

Visit SingleCare.com and enter your drug and zip code. The site shows you nearby pharmacies and their discounted prices. It includes CVS, Walgreens, Walmart, and local independents. You can also use the SingleCare app to find the lowest price near you in real time.

Next Steps

Start by listing your prescriptions. Compare your current Medicare copays to SingleCare prices. Do this for each drug. If one or two drugs are much cheaper on SingleCare, use it for those. Keep using Medicare for the rest.

Revisit this every January during Open Enrollment. Your Medicare plan may change. Your drug needs may change. SingleCare’s discounts change too. Don’t assume last year’s savings will hold.

Most people don’t realize they can mix and match. You don’t have to choose one or the other. Use the system that saves you the most - and never pay full price if you don’t have to.