Health Insurance Premium Calculator

Your Premium Breakdown

Total Premium: $0

Savings Potential: You could save $0 by removing unused coverages

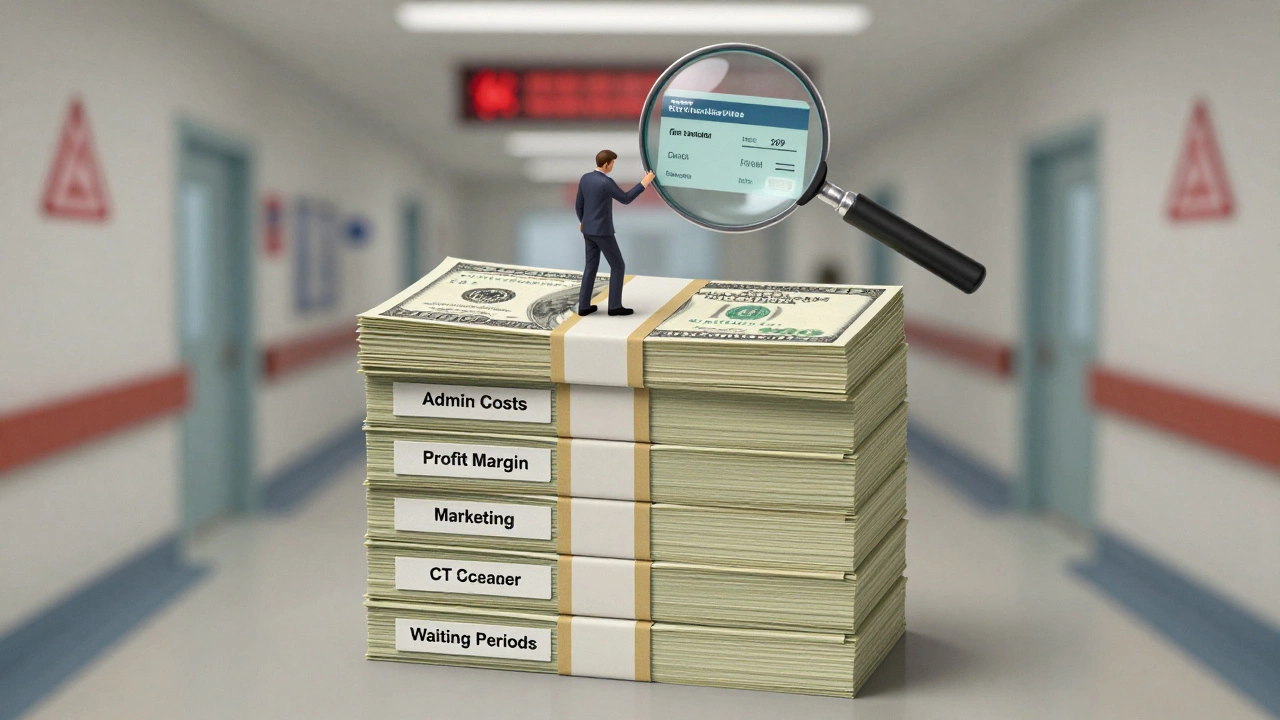

This breakdown shows how your premium is allocated across administrative costs, hospital services, insurance company profits, and optional coverages.

If you’ve ever looked at your private health insurance bill and felt like you’re paying for a luxury yacht instead of basic care, you’re not alone. In 2025, the average annual premium for an individual in New Zealand’s private health insurance market hit $3,200-up 18% in just two years. For families, it’s often over $9,000. That’s more than many people pay for rent. So why does something meant to protect your health cost so much?

It’s Not Just About Doctors

Most people assume their premium covers doctor visits and hospital stays. But private health insurance doesn’t just pay for care-it pays for the entire system around it. That includes expensive medical equipment, 24/7 hospital staffing, administrative teams, marketing, and profit margins for insurance companies. In fact, administrative costs alone make up nearly 20% of every dollar spent in private systems like the U.S. and Australia. In New Zealand, where private insurance fills gaps in the public system, that percentage is rising as insurers compete for customers with fancy add-ons like dental plans, mental health apps, and wellness coaching.Hospital Costs Are Skyrocketing

A single overnight stay in a private hospital in Auckland can cost $2,500. Add surgery, an MRI, or a specialist consultation, and you’re looking at $15,000 before you even walk out the door. These aren’t inflated prices because hospitals are greedy-they’re the result of rising labor costs, outdated infrastructure, and the fact that most medical technology is imported and taxed. A new CT scanner can cost over $1 million. Hospitals have to spread that cost across every patient who uses it. Private insurers pay more than public health systems because they don’t get bulk discounts. Public hospitals negotiate prices as a single buyer. Private insurers? They’re each negotiating alone.Insurance Companies Aren’t Losing Money-They’re Making It

You might think insurance companies are just middlemen, but they’re businesses with shareholders. In 2024, New Zealand’s top three private health insurers reported combined profits of $187 million. That’s not a small number. And while they claim rising premiums are due to “increasing claims,” the truth is more nuanced. Many insurers raise prices not because they’re paying out more, but because they can. People don’t shop around. They stay with the same provider for years, even when premiums jump 10% a year. That’s called customer lock-in-and it’s built into the system.

Pre-Existing Conditions Are a Big Factor

If you’ve had diabetes, back pain, or anxiety before signing up, you’re likely paying more. Insurers don’t cover pre-existing conditions right away-or sometimes at all. To make up for the risk of covering people who are already sick, they charge everyone else more. It’s called risk pooling, but it doesn’t feel fair when you’re healthy and still paying extra. Some insurers try to hide this by offering “no waiting periods” on certain treatments, but they’ll often cap how much they’ll pay for those conditions. You’re not getting full coverage-you’re getting partial coverage at full price.More Coverage Doesn’t Mean Better Value

Insurers know people want “comprehensive” plans. So they stack on extras: physio, acupuncture, alternative therapies, overseas emergency care. Sounds great, right? But here’s the catch: most people never use 70% of those benefits. You might pay $80 extra a month for a mental health app subscription you never open. Or for overseas medical evacuation-something you’ll probably never need. Those extras inflate your premium, but they don’t improve your day-to-day care. The real value is in core hospital and surgical coverage. Everything else is noise.There’s No Price Transparency

Try finding out how much a knee replacement will cost before you book it. Good luck. Private hospitals and insurers don’t publish standard prices. You’ll get a quote after you’ve already seen the specialist, and it’ll change based on who you’re seeing, what hospital you pick, and whether they’re in-network. One patient in Wellington paid $12,000 for the same surgery that cost $7,500 in Christchurch-same surgeon, same hospital chain, just different location. Without transparent pricing, you can’t compare. And without comparison, you can’t negotiate. That’s how prices keep climbing.

Public System Strain Pushes People Into Private

Wait times for public surgeries in New Zealand have hit record levels. Some people wait over a year for hip replacements. That’s not just frustrating-it’s painful. So people turn to private insurance to jump the queue. But as more people move into private care, demand goes up. And when demand rises, prices rise too. It’s a cycle: public system gets backed up → more people buy private insurance → private hospitals raise prices → public system gets even less funding → wait times get longer. The private system isn’t fixing the public one-it’s feeding off its failure.What You Can Do About It

You don’t have to accept high premiums as inevitable. Start by stripping your plan down to the essentials: hospital cover, surgical procedures, and emergency care. Drop the extras you don’t use. Look at insurers that offer direct billing with hospitals-no upfront payments, no paperwork. Compare policies using the private health insurance comparison tool from the Ministry of Health. It’s free, updated monthly, and doesn’t push any brand. Also, check if your employer offers group insurance. Those rates are often 30% lower because they’re negotiated at scale. And if you’re young and healthy, consider a high-deductible plan. You pay less monthly, and you only pay out-of-pocket if something serious happens.It’s Not Just About Money-It’s About Control

The real problem isn’t just the cost. It’s that you’re paying for a system that doesn’t always put your needs first. You might get to see a specialist faster, but you’re still stuck with the same limited network of providers. You might get a private room, but you’re still waiting weeks for test results. The private system sells peace of mind. But peace of mind shouldn’t cost your entire savings. The question isn’t whether you can afford it-it’s whether you should have to.Why is private health insurance more expensive than public healthcare?

Private health insurance costs more because it doesn’t benefit from government bulk purchasing, public subsidies, or cost controls. Public systems negotiate lower prices for drugs, equipment, and staff wages. Private insurers pay full market rates, add administrative overhead, and include profit margins-all passed on to you as higher premiums.

Do I really need private health insurance if I have public healthcare?

Not necessarily. Public healthcare covers all essential treatments, including emergency care, surgeries, and chronic disease management. Private insurance mainly helps you avoid long wait times and gives you choice in hospitals and specialists. If you can wait, public care is just as effective. Private insurance is useful if you want faster access, private rooms, or coverage for services the public system doesn’t fully fund-like some dental or mental health treatments.

Can I save money by switching insurers?

Yes, but only if you’re not locked into a plan with unnecessary extras. Many people pay $200+ extra per month for benefits they never use-like overseas travel medical or wellness programs. Compare plans using the Ministry of Health’s tool. Look at the actual coverage, not the marketing. A cheaper plan with fewer bells and whistles often gives you better value than an expensive one that promises everything.

Why do premiums keep rising every year?

Three main reasons: medical costs are increasing, more people are using private care due to public system delays, and insurers know customers rarely switch. New technology, aging populations, and higher wages for healthcare workers all drive up costs. Insurers raise prices because they can-many customers stay put even when premiums jump 10% or more.

Are there alternatives to private health insurance?

Absolutely. You can set up a dedicated health savings account and pay for care out of pocket when needed. Many people do this for routine care like physio or dental. For major procedures, public hospitals provide free or low-cost treatment. Some employers offer health stipends. And in New Zealand, the Accident Compensation Corporation (ACC) covers most injury-related care-no insurance needed. Private insurance isn’t the only path to care.